The crypto world keeps improving everyday with new features being introduced for users to benefit from. As a first time or seasoned crypto trader, you might have come across the words perpetual contracts – one of the most widely used instruments in the crypto world among both professional and retail traders.

Perpetual Contracts have to do with the speculation on prices of digital assets without having to worry about the contract expiring. Simply put, perpetual contracts are bets placed on whether a digital asset’s price will come down or go up, with no expiration date. As a trader, it is important to be informed about how perpetual contracts work and how to navigate them smartly.

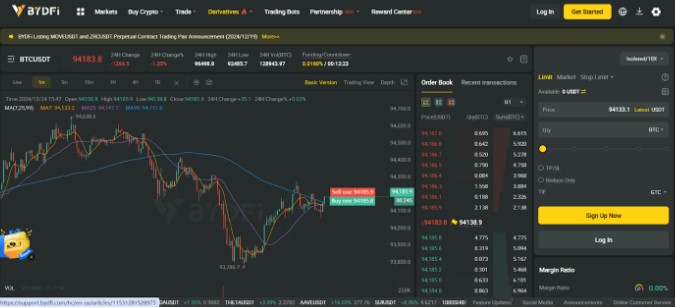

That is where BYDFi perpetual trading lessons come in, a means of understanding the deep level of strategies perpetual contracts require. BYDFi is a one-stop social trading platform for individual investors and has become known for its impressive features like 200x leverage, wide range of cryptocurrencies, and fast execution.

They have a perpetual contract platform which serves as a solid learning ground for both newcomers and seasoned traders in the trading world. You get exposed to real-time resources and tools to help you create confident strategies.

What Are Perpetual Contracts?

Perpetual contracts are a lot more complicated than they actually seem, so it is important to understand the basics before diving into it. They are a type of futures contract that allow traders to hold their positions for as long as they want without any expiration date, making them different from traditional futures contracts.

In simpler terms, here is how trading perpetual contracts work:

- Settlement: There is something called funding rates which traders must monitor since there are no expiry dates. Profits and losses are settled daily through funding rates.

- Go Long: You think a cryptocurrency like bitcoin will go up, so you buy a perpetual contract.

- Go Short: You think Bitcoin will crash, so you sell a perpetual contract.

- Leverage: This is a dangerous but potentially profitable method that allows you to borrow money to place bigger bets.

As written above, traders have to monitor funding rates, market volatility, and margin levels closely because there are no expiry dates. This is why information is critical, because you need to know the right steps to take. Platforms like BYDFi have managed to balance both functionality and knowledge.

Lessons Every Trader Should Learn When Trading Perpetuals

- Understanding Leverage: One important lesson is truly understanding that leverage is a double-edged sword. In other words, once you understand that 10x leverage equals 10x risk and not just 10x profits, you are on the right path. Though BYDFi allows flexible leverage settings across perpetual contracts, you should still be smart when making decisions.

- Master Risk Management: Developing risk management skills early will help you. For traders that are already good at setting stop-losses and sticking to them in spot trading, they could easily apply those skills to perpetual contracts.

- Understand the Funding Rate: This is a lesson that is usually overlooked when it comes to perpetual contracts. Funding fees are periodic payments exchanged between short and long positions. Sometimes, traders can end up paying fees for simply holding positions overnight, which can eventually add up. On BYDFi, you’ll find funding intervals and rates clearly displayed, aiding your strategy.

- Start Small: In everything you do, you need to start small – especially if you’re new to perpetual contracts. Avoid large positions and go for minimal leverage like 2x or 3x regardless of how small the profits will be. You can then continue to increase the figure as you understand how funding mechanisms and margin work.

BYDFi’s Strengths in Perpetual Trading

BYDFi is known for offering high-quality trading tools on a user-friendly interface so first-time traders do not feel too overwhelmed and seasoned traders do not feel underwhelmed. Perpetual trading on BYDFi has been made accessible and simple, catering to both advanced and new users.

Some highlights of the platform include:

- A user-friendly interface which keeps every information understandable and accessible. Traders have access to key information like current position details available margin, liquidation price warnings, and unrealized profit/loss.

- Hedging for Long-Short Positioning: This new hedging function on BYDFi allows users to do two things – hold both short and long orders in the same trading pair and lock income when they realize risk hedging. Users can hedge operations for any reason whatsoever.

- Cross Margin Mode: Users don’t have to manually put in the margin for every trade because the BYDFi system will distribute funds across all open positions automatically.

- Educational Resources: BYDFi provides users with resources to help their trading process like market analysis tools, risk calculators, and interactive tutorials.

- Users have access to up to 200x leverage for perpetual contracts and up to 400+ crypto trading pairs.

Education is the Real Edge

Trading perpetual contracts is less about luck and more about being informed. Users have to be disciplined and constantly get educated so as to make the right decisions at every turn. BYDFi understands the importance of information, which is why they offer the necessary resources and tools to keep traders on the right path.